Our Vision

The landscape of climate action is rapidly evolving, driven by expanding corporate pledges and increasing governmental and international regulations on carbon dioxide emissions. Many companies are committing to ambitious net-zero targets as governments and regulatory bodies around the world are enacting stricter regulations to ensure tangible results.

Source: Net Zero Climate

The Issue

The bulk of emissions – especially in sectors like energy, which make up 70% of global emissions – will be difficult to immediately abate.

Carbon offsets

These firms will need to turn to carbon offsets to meet their environmental goals.

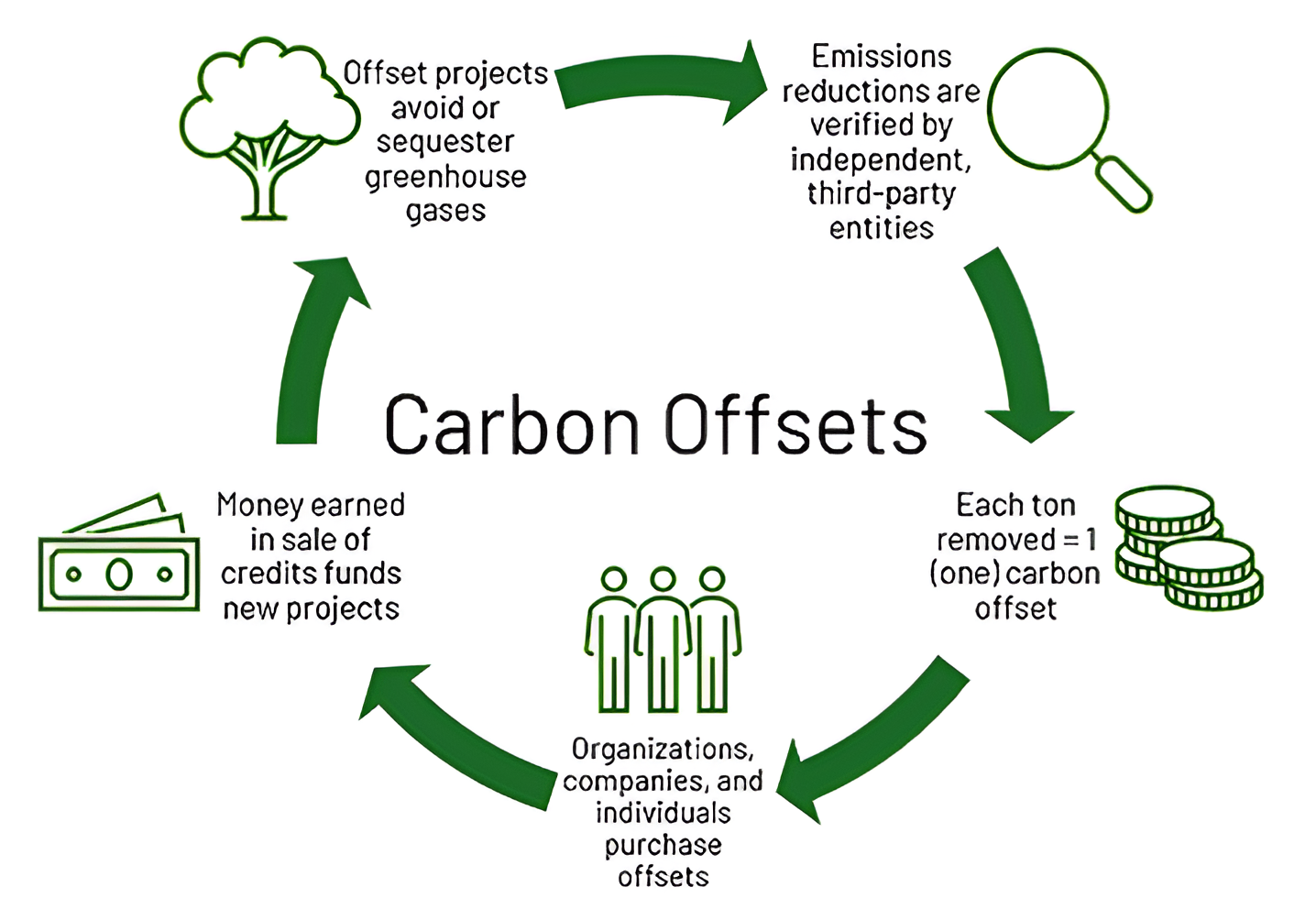

Carbon offsets represent carbon dioxide that has been reduced, avoided, or removed from the atmosphere, with each credit equaling one ton of CO2. Projects that reduce, avoid, or remove carbon can generate credits and sell them to polluting companies, which may then ‘retire’ these credits to offset the firm’s unavoidable emissions.

The Need for Carbon Services

Businesses are facing mounting pressure to address their carbon footprint. Customers, clients, and other parties are increasingly prioritizing environmentally responsible companies. Governments worldwide are also tightening emission regulations, meaning compliance is no longer optional – it’s a strategic imperative. At the same time, investors are evaluating climate risk more and more in their decision-making.

Navigating this evolving landscape can be daunting. The patchwork of compliance requirements across different jurisdictions and the balance of short-term cost implications with long-term sustainability goals can be a complex headache for many entities.

Fundamental Analytics Carbon Services

Fundamental Analytics Carbon Services (FACS) is a boutique, one-stop-shop that meets these challenges. Our integrated pipeline brings together both sides of the carbon equation: demand (carbon emitters through our extensive network of industrial emitters) and supply (through our industry expertise and connection to credit-generating projects).

These come together in our research platform, which provides carbon market participants with data feeds and intelligence tools for market and operation research.

Targeting Three Industry Verticals

We Target Three Industry Verticals in Need of Carbon Services

Energy Transition

The US energy transition to net-zero will require $12 trillion in investment. The transition has been accelerated by the passing of the Inflation Reduction Act, which will mobilize hundreds of billions of federal funding, private investment, and drive growth in carbon capture, utilization, and storage technologies.

Maritime Shipping

Maritime shipping, which contributes 3% to the world’s greenhouse gas emissions, faces increasing regulatory and societal pressure to decarbonize. Newly implemented and oncoming regulations in the European Union and elsewhere have accelerated the need for carbon services in shipping.

Metals and Mining

The metals and mining industry represents 15% of global emissions and is affected by emissions regulation regimes worldwide.

Our Four Pillars of Services

FACS Platform

We offer a powerful, scalable web platform for managing emission data and compliance by streamlining compliance needs and data integration along with the ability to trade carbon instruments.

CBAM & Regulatory Advisory Services

Our team, with over 40 years of collective experience and connections in global carbon markets, offers unparalleled expertise and boutique strategies, including specialized services for the EU ETS and EU CBAM to optimize and ensure compliance.

Sales & Trading

Our brokerage services specialize in both marketing and trading carbon instruments from both regulatory and voluntary markets. By leveraging our unique trading strategies and algorithms, we help clients in minimizing their financial risk.

Project Development

Our connections to project developers and financiers enables FACS to transform ideas into actionable credit-generating projects that align with our clients’ sustainability goals.